Are you looking for a secure, reliable way to accept payments online? Are you curious about what is a payment gateway and how it works? If so, then you've come to the right place. In this blog post, we'll talk about what a payment gateway is and why it's an essential part of any online business.

A payment gateway is a tool that enables merchants to accept payments online. It securely processes credit card, debit card, and other types of payments from customers. Payment gateways act as intermediaries between merchants and customers, providing a secure connection between the two parties to ensure data is transmitted safely and accurately. Payment gateways are used by merchants of all sizes, from small businesses to large corporations, to process payments quickly and securely. see also best payment gateway

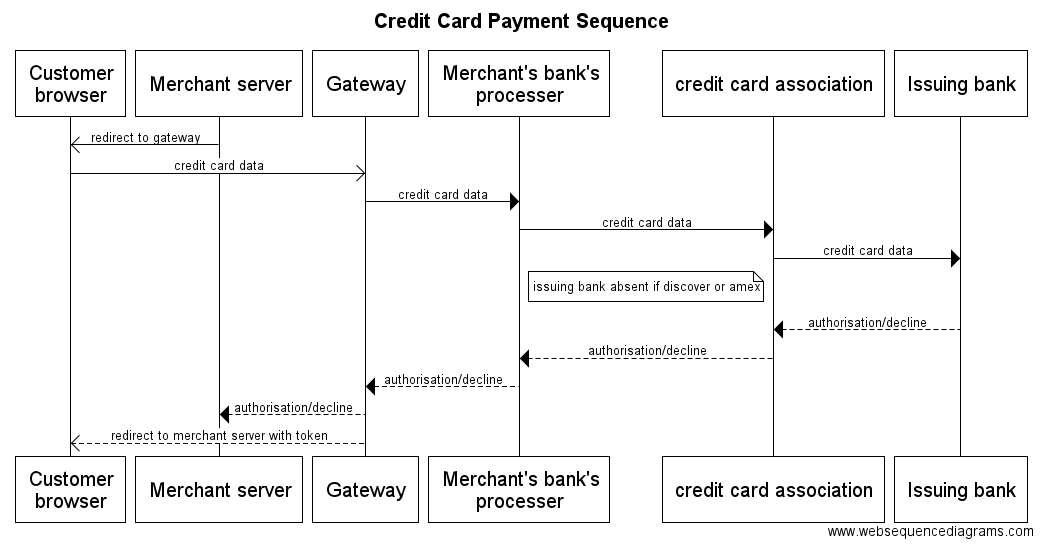

Not only do payment gateways provide a secure connection for sensitive information, but they also help merchants reduce their fraud risk, streamline their payment process, and increase their revenue potential.This image was fetched from google search and was first found at: upload.wikimedia.orgHow Does a Payment Gateway WorkA payment gateway is the gateway to secure online payments. It is the technology that securely captures, stores, and transmits card information from the customer to the merchant’s bank account. Payment gateways process credit card payments for online and traditional brick-and-mortar stores. After collecting customer card information, the payment gateway encrypts it for processing. Once encrypted, it is sent to a payment processor who charges the customer’s account. Payment gateways authorize funds transfers between buyers and sellers and allows e-commerce sites to request money from a customer’s bank. Payment gateways are an essential part of any e-commerce business, as it allows customers to securely pay for goods and services online.This image was fetched from google search and was first found at: www.retaildogma.comThe Benefits of Using a Payment GatewayUsing a payment gateway has many benefits, including increased security, convenience, and faster payment processing. With a payment gateway, customers can pay with their credit or debit cards in a secure environment. This simplifies the payment process and can help reduce impulse buying. Payment gateways act as an intermediator between the merchant's website and the acquiring bank, transferring cardholder data and authenticating online payments. This provides faster payment processing compared to manual processing, allowing businesses to receive payments quicker and more conveniently. Additionally, payment gateways come with additional features such as fraud protection and customer analytics to ensure your business is secure and your customers are happy. With the right payment gateway, businesses can easily integrate it into their website and start accepting payments with ease.This image was fetched from google search and was first found at: www.retaildogma.comTypes of Payment GatewaysPayment gateways come in several different varieties, each with its own unique benefits and features. The three main types are hosted, self-hosted, and API-hosted. Hosted payment gateways are the most common type, providing an all-in-one solution for online payment processing. Self-hosted payment gateways involve more technical setup, but also provide a higher degree of flexibility. API-hosted payment gateways are the most complex and are often used by developers who want to integrate their payment gateway into their existing applications. Local bank integration gateways are also popular, allowing businesses to process payments directly through their local bank. All of these types of payment gateways have their own advantages and disadvantages, so it’s important to do your research before deciding which one is right for you.This image was fetched from google search and was first found at: www.retaildogma.comHow to Choose the Right Payment GatewayChoosing the right payment gateway for your business is essential if you want to offer a smooth checkout experience to your customers. To make sure you’re picking the right one, there are a few factors to consider when evaluating payment gateways. First, check the pricing and fees associated with the gateway. This includes transaction fees and any additional fees that may be charged. You should also look at the coverage of the payment gateway and make sure it’s available in your customers’ countries or regions. Additionally, consider the features of the payment gateway, such as processing speed, data collection, and customer service. Finally, make sure that your payment gateway is secure and PCI compliant. By taking these factors into consideration, you can rest assured that you’ll find the right payment gateway for your business.This image was fetched from google search and was first found at: live.staticflickr.comWhat to Look for in a Payment GatewayWhen choosing a payment gateway, it's important to look for features and services that meet your business needs. Make sure the gateway you choose is compatible with your ecommerce platform and accepts the card types you want to accept. Additionally, check the gateway’s location and incorporation details to ensure it meets all data security regulations. Finally, make sure your payment gateway offers secure encryption standards to protect customer data. With the right payment gateway, you’ll have the tools you need to process payments quickly and securely.This image was fetched from google search and was first found at: www.firewelltechnologysolutions.comSecuring Your Payment GatewayWhen it comes to payment gateways, security is of the utmost importance. Payment gateways must be able to protect customer data from potential hackers and other malicious actors. To ensure the safety of customer information, payment gateways employ a variety of security measures such as data encryption, 3D Secure, and PCI DSS compliance. Data encryption scrambles customer data, making it unreadable to anyone who doesn’t have the decryption key. 3D Secure adds an extra layer of authentication to protect customers from fraud. PCI DSS compliance ensures that payment gateways adhere to stringent security standards. With these measures in place, businesses can rest assured knowing that their customers’ information is safe and secure.This image was fetched from google search and was first found at: live.staticflickr.comOnline Payment Processing with a Payment GatewayPayment gateways enable businesses to securely collect online payments from their customers. With a payment gateway, customers initiate a transaction and the payment processor facilitates communication between the customer and the merchant's bank account. This ensures that the payment is securely transferred without any risk of fraud or data theft. Payment gateways also provide merchants with additional features such as fraud prevention, customer service support, and analytics. All of these features ensure that businesses can process payments quickly and securely.This image was fetched from google search and was first found at: live.staticflickr.comIntegrating Your Payment GatewayIntegrating your payment gateway is an essential part of setting up your online store. There are several options available to you, depending on the platform you choose to use. WooCommerce, Shopify, and Magento are popular options, each offering its own set of features and payment gateways. When choosing a payment gateway integration, you should look for a seamless user experience. An integrated payment gateway is embedded into your app through payment APIs, allowing customers to make quick and secure payments without ever leaving your site.This image was fetched from google search and was first found at: uploads-ssl.webflow.comThe Future of Payment GatewaysThe future of payment gateways looks very promising. As technology advances, more secure and user-friendly payment gateways are being developed. These new gateways offer a range of features that make it easier for merchants to accept payments quickly and securely. Moreover, these new payment gateways also allow for more customization options, so merchants can tailor their payment gateway to suit their specific needs. With the increasing popularity of digital payments, it is likely that payment gateways will continue to evolve and become even more widely used in the future

created with

HTML Website Builder .